The Diesel Market Is Soaring, And Gasoline Prices Will Catch Up This Summer

The Diesel Market Is Soaring, And Gasoline Prices Will Catch Up This Summer

By Ryan Fitzmaurice, senior commodity strategist of Rabobank

Summary

-

Oil prices recovered firmly above $100 per barrel this week despite the strict and ongoing lock-downs conditions in Communist China and a very strong US Dollar

-

The push for lower carbon fuels has resulted in higher prices at the pump

-

The diesel market has been soaring recently but gasoline prices could catch up this summer

Driving season

It was a choppy week for oil markets, but as it stands, prices are heading into May with positive momentum. Oil prices recovered back above their respective 20-day moving averages this week despite the ongoing Chinese lock-downs and a very strong US Dollar. On that note, the very restrictive measures in Chinese megacity Shanghai have been in place for more than a month now and have even spread to other key cities.

At the same time, the US Dollar index has soared to multi-decade highs. So considering the world’s largest oil importer is effectively shut-down coupled with the currency pressures, the recent strength in oil is notable. This speaks to the tightness of global oil supplies and the likelihood of further downside in Russian oil production, as the West pushes away Russian imports. It also signals that oil prices may be finding good support ahead of the fast approaching high-demand summer months.

As such, we are viewing the supply-side dynamics as more impactful and long-lasting while the Chinese lock-downs are temporary in nature. Further to that end, the inevitable easing of these strict measures in Communist China could unleash significant pent up demand in the coming weeks and months.

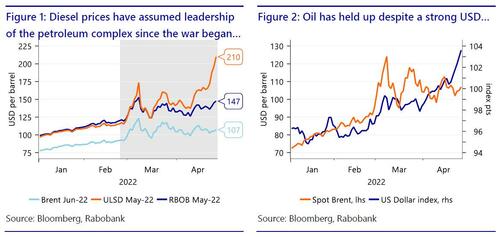

We are also less than five weeks away from the US Memorial Day holiday, which is the unofficial start of the summer driving season in the US. Importantly, it has really been diesel markets that have taken leadership of the petroleum complex in recent weeks as the fundamental story becomes increasingly more bullish for finished fuels.

In fact, spot diesel prices have already soared to all-time highs in many key locations and that comes despite the drop in crude oil prices since the start of the war in Ukraine. On the contrary, diesel prices have charged higher to new highs as shortages develop, and this has led to sharply higher crack spreads and record backwardation in the forward curves.

In our view, the tightness in refined products is likely to persist for months if not years, and any unplanned outages this summer could send gasoline prices soaring with diesel.

Oil refining dynamics

As many are aware, the refining sector is the lifeblood of crude oil demand and the primary source of the finished fuels we all consume on a regular basis. As such, it is a key industry to understand, and especially for those actively trading in global energy markets, whether it be for hedging or speculative purposes.

To that end, US earnings season is upon us and with that analysts and traders are afforded a glimpse into the inner workings of the oil refining industry during the quarterly earnings calls and provided a general outlook for trends in finished fuels. This week we heard from some of the largest US refiners and there were clear themes throughout:

-

Fuel demand is robust and expected to hit record levels this summer

-

Finished fuels supply is tight given the capacity reduction that occurred early in the pandemic

-

Stockpiles of distillate fuels are extremely low in key regions and will be hard to replenish

-

Carbon credits and bio-fuel blending requirements are increasing prices at the pump

-

The sky-high cost of natural gas in Europe is increasing refining costs of hydrocracking diesel

-

US refiners are maximizing diesel yields relative to gasoline to capture the wide spread

The loss of Russian secondary feedstock will be a key issue impacting product yields In our view, these industry trends are valuable nuggets of information and signal that the US refining industry is gearing up for record demand this summer but with much less capacity than before the pandemic. This lack of capacity is also apparent when looking at the extremely attractive diesel margins of late. This dynamic has led to refiners maximizing diesel production at the expense of gasoline given the spread between the two fuels has collapsed to historic levels.

In fact, the gasoline-diesel spread has shifted tremendously, with diesel commanding a significant premium since the start of the war in Ukraine. However, this historically wide spread could narrow as we enter driving season and the reason has to do with the last theme above, the loss of Russian feedstock such as Vacuum Gasoil (VGO). This feedstock is typically processed by key US refineries and is used to fill secondary processing units such as hydrocrackers that increase the yield of finished fuels. This loss of Russian VGO will now force refiners to decide on whether incremental barrels are processed into diesel via a hydrocracker or gasoline via a cat-cracker (FCC). This competition could result in mean reversion in the notoriously volatile gasoline-diesel spread, with gasoline gaining ground to ensure refiners produce sufficient gasoline supplies.

Looking Forward

Looking forward, we continue to see more upside risks than downside with respect to crude oil prices and view the increasing tightness in finished fuels as providing strong underlying support as we approach the driving season. Furthermore, the lack of spare refining capacity in the West will increase the sensitivity and price response should there be any major unplanned outages this summer while the loss of Russian VGO will likely cap refinery utilization rates.

Tyler Durden

Sun, 05/01/2022 – 10:30

dollar

commodity

markets

us dollar

The post The Diesel Market Is Soaring, And Gasoline Prices Will Catch Up This Summer appeared first on NXTmine.

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://www.nxtmine.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.

The post The Diesel Market Is Soaring, And Gasoline Prices Will Catch Up This Summer first appeared on USSA News. Visit USSANews.com.