China Continues To Enslave Low And Middle-Income Countries With Unsustainable Debt

OBIDEN THE FAMOUS BOLD FACED LIAR

DEBT SERFS

If you’ve not read it yet, Confessions of an Economic Hitman by John Perkins highlights how the West via the IMF, World Bank, and CIA and in collusion with big business routinely have enslaved developing world nations.

Now it is China that leads the way employing the very same tactic. Shall we call it corruption with Chinese characteristics?

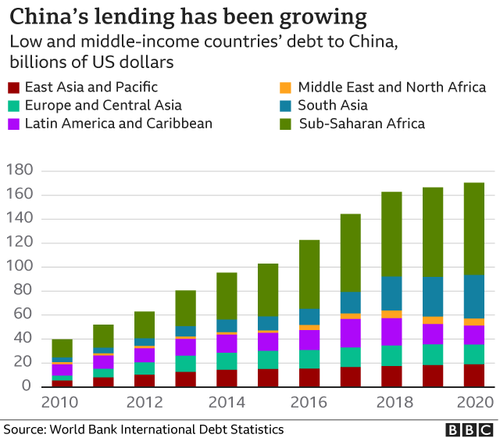

China: Is it burdening poor countries with unsustainable debt? – BBC News

Research by AidData, an international development body at William & Mary University in the US, finds that half of China’s lending to developing countries is not reported in official debt statistics.

It is often kept off government balance sheets, directed to state-owned companies and banks, joint ventures or private institutions, rather than directly from government to government.

There are now more than 40 low and middle-income countries, according to AidData, whose debt exposure to Chinese lenders is more than 10% of the size of their annual economic output (GDP) as a result of this “hidden debt”.

Djibouti, Laos, Zambia and Kyrgyzstan have debts to China equivalent to at least 20% of their annual GDP.

Case in point is, of course, Sri Lanka where recently the President of Sri Lanka, a fella named Rajapaksa, told the visiting Chinese Foreign Minister, a fella who goes by the name of Wang Yi, the following:

It would be a great relief to the country if the attention could be paid on restructuring the debt repayments as a solution to the economic crisis that has arisen in the face of the COVID-19 pandemic.

You don’t say!

Over the past decade, China has loaned Sri Lanka more than $5 billion for highways, ports, an airport, and a coal power plant. Critics say that the funds were used for white elephant projects with low returns.

Of course!

The ROI isn’t measured in project funding but in political power over the entire country. I mean jeepers, why limit yourself to the investment returns on a mere port when you can extract so much more? Why indeed.

If you need a quick reminder, Sri Lanka is a key part of Beijing’s Belt and Road Initiative, ostensibly a long-term plan to fund and build infrastructure linking China to the rest of the world but covertly a means of bringing entire countries into and under the economic and military “persuasion” of the CCP.

How Our Fund Is Frontrunning The Economic Madness In 2022 And Beyond

- Copper – Copper prices have to rise to address a huge supply deficit looming on the horizon.

- Shipping – Shipping is vital for the functioning of the modern world, yet is priced for bankruptcy.

- Eastern Europe – Position for the long term trend of capital moving from the West to the East with Polish and Russian equities markets.

- US Dollar – We’re bearish all paper currencies, but believe that the USD will outperform all others.

- Base Metals – Clean energy targets require more battery metals than existing global supply.

- Off Shore Oil & Gas – Offshore oil investment has been smashed, yet consumption continues to grow.

- Rare Earth Metals – A play on geopolitics and a cycle that should see a repricing of these commodities.

- Russion Oil & Gas – Virtue signalling abandonment of fossil fuels led by Western oil co’s means Russia is taking up the slack.

- Uranium – The looming supply deficit promises to pay handsomely when the market inevitably reprices.

- Gold – Gold sees the perfect storm; the turn of a cycle, supply issues and lack of faith in sovereign currency.

- Coal – Modern society is dependent on coal, with supply continually growing. Is there a more hated investment?

- Personal Defense – Order is breaking down in the US, and the unrest is giving us an opportunity to position for asymmetry.

- Agriculture – Lockdowns and monetary stimulus have ensured food prices will rise, providing deep value.

- Natural Gas – Supply and demand dynamics coupled with dependency from the US provides a great opportunity.

- Plus much much more…

If these themes make sense to you then click the link below to learn more about Capitalist Exploits and how you can play along.