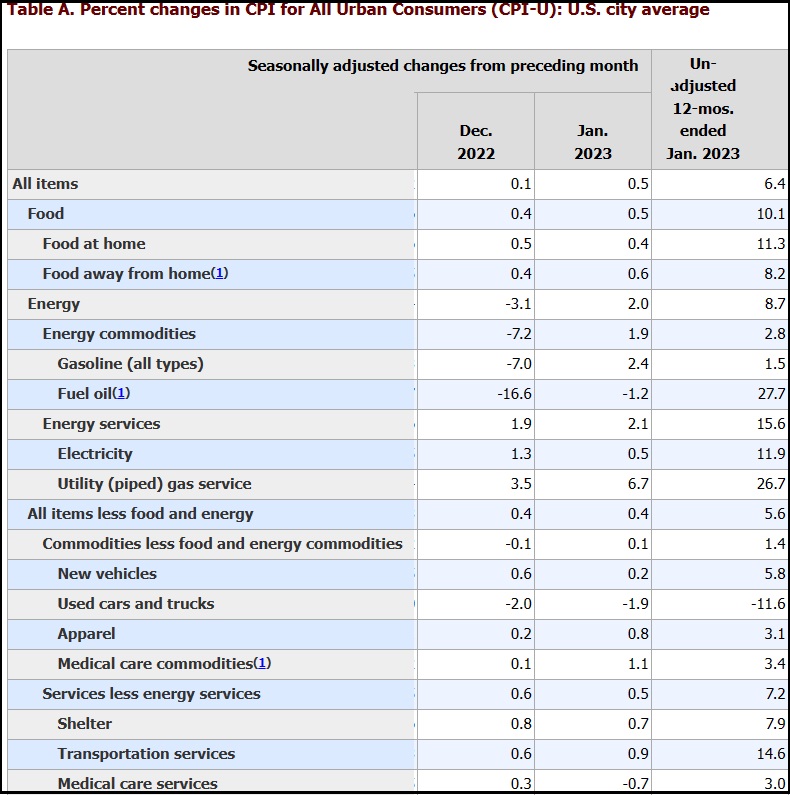

Consumer Price Index Increases 0.5 in January, 6.4% Annual Inflation Rate

The Bureau of Labor and Statistics released the January consumer price index today [DATA HERE] reflecting what you already know. The overall inflation rate stands at 6.4%, after the anniversaries of the first two waves of price increases have now tolled.

Inflation is the measure of price increases over time. Following two years of massive jumps in price, we are now cycling through and comparing current prices to the previous period when prices had already skyrocketed.

Inflation is the measure of price increases over time. Following two years of massive jumps in price, we are now cycling through and comparing current prices to the previous period when prices had already skyrocketed.

This gives a false impression of price moderation (hindsight inflation); however, the price of goods and services is significantly higher, and those prices will not drop. The higher prices are now embedded in the economy.

After a brief respite, a plateau, in energy price increases over Nov (0.5%) and December (0.4%), the January energy prices began climbing again (0.6%). This is what we have all noticed in the past three months.

Additionally, “shelter” costs, rent and housing, continue to increase in price (0.8%, January). Overall shelter costs now +7.9% for the 12 months preceding January, 2023, with rents up 8.6% for the period [Table-1].

We have also cycled through the anniversary of the first two waves of massive food price increases, ending January 2022. Despite that cycle, food prices still show an increase of 10.1% for the preceding 12 months. Cereals +15.6%, dairy +14.0%. These food price increases are on top of similar jumps in the period that preceded January ’22. Most of these volatile food price increases are attributable to the overall scale of energy and transportation costs. These prices will never reverse.

The issue is compounded because the inflation rate is still far exceeding the rate of wage growth. This means workers and working families are going backwards and spending more than they earn for the exact same housing, food and energy products they were purchasing a year ago.

The issue is compounded because the inflation rate is still far exceeding the rate of wage growth. This means workers and working families are going backwards and spending more than they earn for the exact same housing, food and energy products they were purchasing a year ago.

This wage squeeze means little to no disposable income, which then applies to the rest of the household checkbook economics. With less disposable income, fewer non-essential products and/or services are purchased by working families. This situation creates the snowball effect of lessened overall economic activity.

(Via CNBC) – […] Rising shelter costs accounted for about half the monthly increase, the Bureau of Labor Statistics said in the report. The component accounts for more than one-third of the index and rose 0.7% on the month and was up 7.9% from a year ago. The CPI had risen 0.1% in December.

Energy also was a significant contributor, up 2% and 8.7%, respectively, while food costs rose 0.5% and 10.1%, respectively.

Rising prices meant a loss in real pay for workers. Average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, according to a separate BLS report that adjusts wages for inflation.

While price increases had been abating in recent months, January’s data shows inflation is still a force in a U.S. economy in danger of slipping into recession this year. (read more)

According to the wage report: “from January 2022 to January 2023. The change in real average hourly earnings combined with an increase of 0.3 percent in the average workweek resulted in a 1.5-percent decrease in real average weekly earnings over this period.” Workers are working longer hours, making slightly more pay, but the rate of inflation means their actual “real wages” are still dropping.

The way to break out of this cycle is to first unleash the U.S. energy sector and drive down the costs of oil, gasoline, diesel fuel, home heating oil, natural gas and electricity rates. However, the entrenched nature of the climate change ideology, blocks the professional political class from providing the energy sector relief. Both Democrats and Republicans want the Joe Biden “green new deal” energy policy.

FUBAR!